1 min read

1 min read

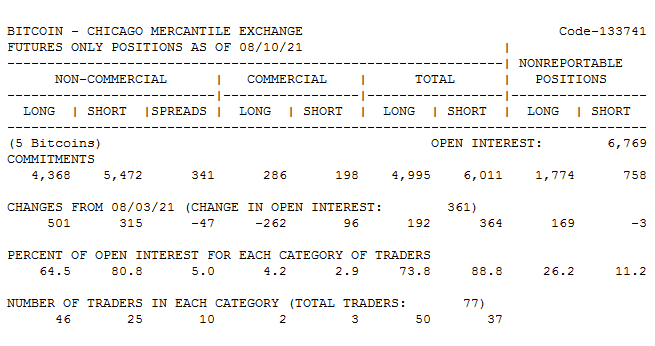

According to COT (Commitments of Traders) reports provided by the Commodity Futures Trading Commission (CFTC) - for the week ending last Tuesday:

Large speculators (NON-COMMERCIAL) reduced their net position for selling contracts for bitcoin by 0.19 thousand contracts to 1.10 thousand. Large speculative players reduce their net position for selling for the second week in a row after a 2-week increase. The net position became the lowest since May 18.

Hedgers (COMMERCIAL) reduced the net position for buying contracts for bitcoin by 0.36 thousand contracts to 0.09 thousand. Hedgers-operators are also reducing the net position for buying for the second week in a row.

Small speculators (NONREPORTABLE POSITIONS) increased their net position for buying Bitcoin contracts by 0.17 thousand contracts to 1.02 thousand. Small speculators are increasing their net position for buying 2 weeks out of the last 3.

Open interest grew by 0.36 thousand contracts to 6.77 thousand.

The bearish index of large speculators (the ratio of the number of contracts to sell to the number of contracts to buy) dropped over the week by 0.08 to 1.25.

Bottom Line: Bitcoin COT data reflects the rise in bullish sentiment among large speculators. For the second week, large funds are cutting their net position for a decrease in BTC (-14% per week). At the same time, the net position became the minimum for the last almost 3 months. The continuation of this trend may contribute to the growth of the cryptocurrency.

Longer-term hedgers also noticeably reduced their net position aimed at lowering Bitcoin.

Small speculators have been increasing their purchases in the last week. Bullish sentiment has also increased among small speculators, although this group of traders usually does not have a significant impact on the market.

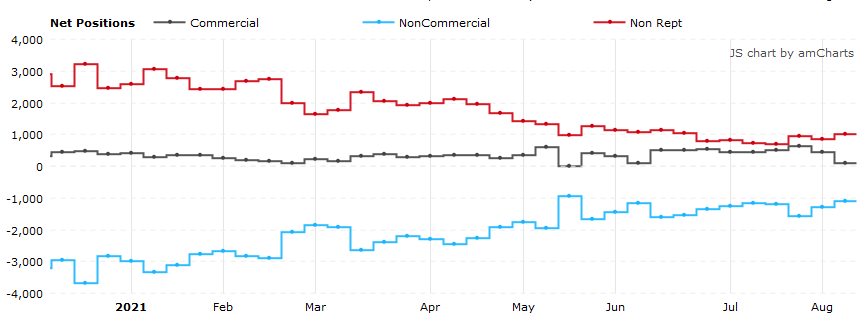

Note: COT report data is fundamental and is used primarily for medium to long term trading. Large speculators, NON-COMMERCIAL (banks, investment funds) usually trade along the trend (blue line). Small speculators, NONREPORTABLE POSITIONS - usually do not have much influence on the market (red line). Hedgers, COMMERCIAL (operators, large companies) usually trade against the trend (black line). The net position is the difference between the number of buy and sell contracts. Open interest is the sum of all open positions in the market.

It is very important for trading or investing to work with a reliable and trusted broker. Choose the company that suits you from our rating of brokers.

1 min read

1 min read

5 min read

5 min read

.png)