3 min read

3 min read

EURUSD

The euro is ready to start an uptrend towards the 1.2100 level. Small consolidation, spikes and reversal volatility in the 1.800 - 1.700 price range can still be expected this week. In case of breakdown and consolidation below the level of 1.700, options for opening short positions can be considered. The general recommendation is to prepare for an upward reversal and opening long positions, the approximate target is the level of 1.2000.

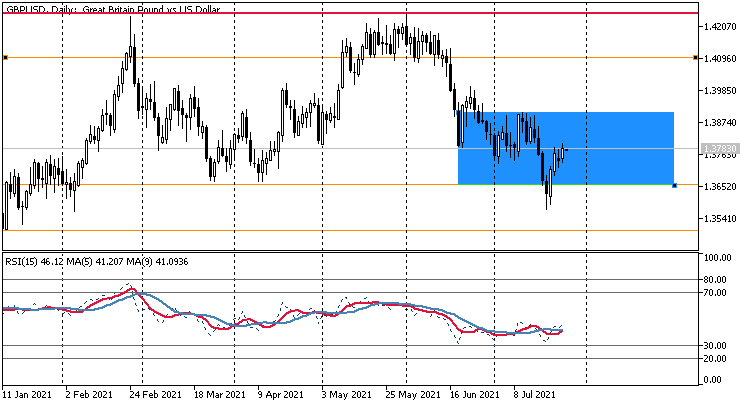

GBPUSD

The pound shows uncertainty and unwillingness to go below 1.3600. Sideways movement is expected in the range from 1.3660 to 1.3900. In case of breakdown of the level of 1.3900, the recommendation to open long positions with the target of 1.4100

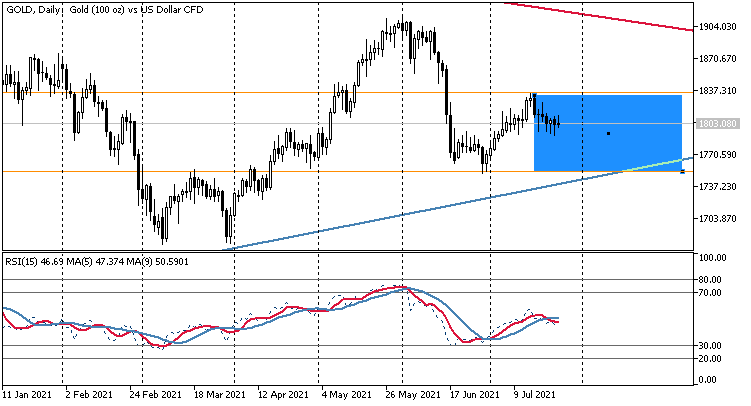

XAUUSD

Gold continues to approach the completion of the triangle formation on the weekly timeframe, the momentum after the completion of the pattern may appear within a few weeks. the trigger for this is the fundamental background, so stay tuned. The range of movement this week is likely to be in the area of 1835.0 - 1750.0. In such a situation, you can use averaging and other systems operating in a flat.

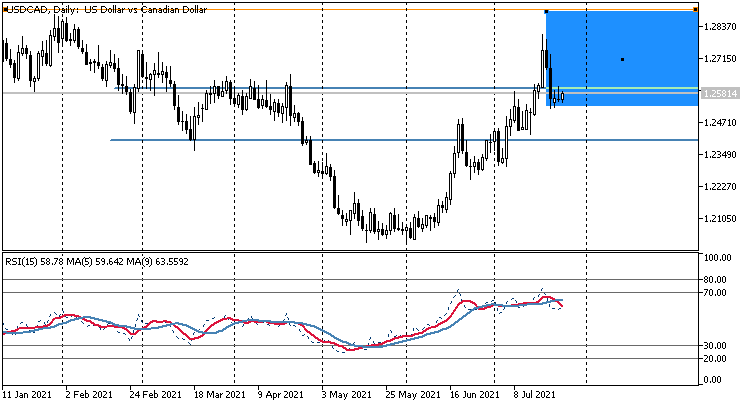

USDCAD

The Canadian continues its upward trend. Only long positions are recommended for opening in order to reach the level of 1.2900.

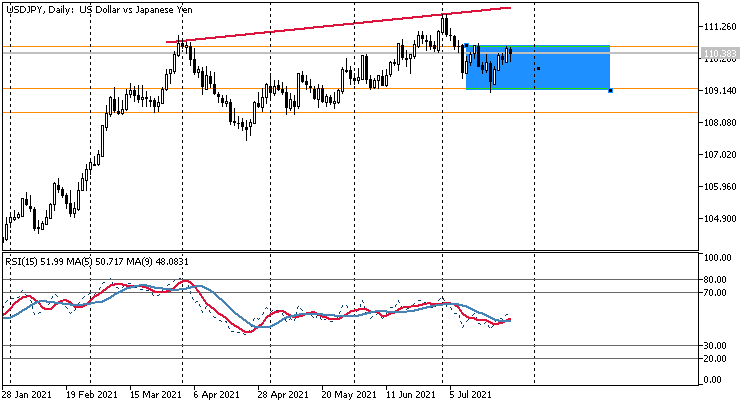

USDJPY

The yen is showing a bearish tone and a good entry point. We consider only short positions with a take profit at 109.200

AUDUSD

The bearish movement of the Austrian will continue in the coming week. We only open sells in case of pullbacks in the 500 pips region, the goal is to reach the price of 0.7200.

NZDUSD

The New Zealander is consolidating in the 0.7100 - 0.6900 range. A recommendation to open short-term deals or refrain from trading due to the absence of a clear trend. However, you can use averaging and other systems that work in a flat or automated trading systems that work under any market conditions.

1 min read

1 min read

1 min read

1 min read

.png)